Health insurance is a form of insurance that provides coverage for medical expenses incurred by individuals. It can be offered by both public and private entities and can either be purchased by individuals on their own or provided as a benefit by their employer.

The purpose of health insurance is to help individuals and families manage the high cost of medical care, which can be a significant financial burden without insurance coverage. In this article, we will discuss the importance of health insurance, the different types of health insurance, and the benefits and drawbacks of each.

Importance of Health Insurance:

The importance of health insurance cannot be overstated. Without health insurance, individuals and families may be forced to pay out of pocket for medical expenses, which can be prohibitively expensive. In addition, individuals without health insurance may be more likely to delay seeking medical care, which can lead to more serious health problems down the road. Health insurance provides peace of mind, knowing that individuals and families are covered in case of unexpected medical expenses.

Types of Health Insurance:

There are several different types of health insurance, each with its own benefits and drawbacks. The most common types of health insurance include:

Employer-Sponsored Health Insurance:

Employer-sponsored health insurance is health insurance provided by an employer as a benefit to its employees. This type of insurance is typically offered as part of a benefits package and may be partially or fully funded by the employer. Employer-sponsored health insurance is often the most affordable option for individuals and families, as employers are able to negotiate lower premiums due to the large number of individuals they insure.

Individual Health Insurance:

Individual health insurance is health insurance purchased by individuals on their own, rather than through an employer. This type of insurance is typically more expensive than employer-sponsored health insurance, as individuals do not have the benefit of group purchasing power. However, individual health insurance can be a good option for individuals who are self-employed or who do not have access to employer-sponsored health insurance.

Medicare:

Medicare is a federal health insurance program that provides coverage for individuals who are 65 years of age or older, as well as individuals with certain disabilities. Medicare is divided into several different parts, each of which provides coverage for different types of medical expenses. Part A provides coverage for hospital stays, while Part B provides coverage for doctor visits and outpatient care. Part C, also known as Medicare Advantage, allows individuals to receive their Medicare benefits through a private insurance company. Part D provides coverage for prescription drugs.

Medicaid:

Medicaid is a federal and state-funded health insurance program that provides coverage for individuals with low incomes. Medicaid covers a wide range of medical expenses, including doctor visits, hospital stays, and prescription drugs. Eligibility for Medicaid varies by state, but typically individuals must have incomes below a certain threshold to qualify.

Benefits and Drawbacks of Health Insurance:

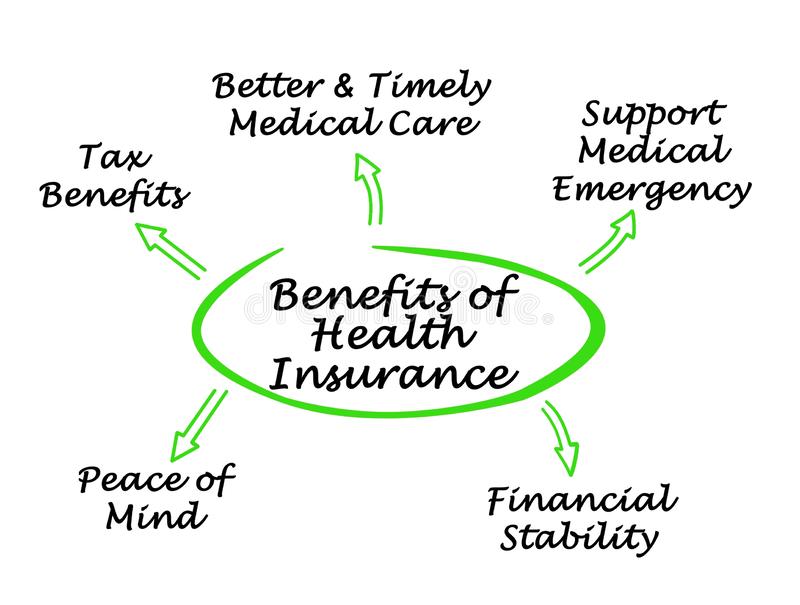

There are several benefits and drawbacks to each type of health insurance. The benefits of health insurance include:

Financial Protection:

Health insurance provides financial protection in case of unexpected medical expenses. Without insurance coverage, individuals and families may be forced to pay out of pocket for medical expenses, which can be prohibitively expensive.

Access to Medical Care:

Health insurance provides access to medical care, which can help individuals and families stay healthy and prevent serious health problems down the road. With insurance coverage, individuals are more likely to seek medical care when they need it, rather than delaying care due to financial concerns.

Peace of Mind:

Health insurance provides peace of mind, knowing that individuals and families are covered in case of unexpected medical expenses. This can help reduce stress and anxiety and allow individuals to focus on their health and well-being.

The drawbacks of health insurance include:

Cost:

Health insurance can be expensive, particularly for individuals who do not have access to employer-sponsored health insurance. Even with employer-sponsored health insurance, individuals may still be responsible for paying a portion of the premium and may have high deductibles or co-payments. This can be a significant financial burden, particularly for individuals with lower incomes.

Limited Coverage:

Some health insurance plans may have limited coverage for certain medical expenses, such as prescription drugs or mental health services. This can make it difficult for individuals to access the care they need, particularly if they have a chronic condition or mental health issue.

Limited Provider Networks:

Some health insurance plans may have limited provider networks, which can make it difficult for individuals to access the care they need. If a provider is not in the network, individuals may be responsible for paying the full cost of care, which can be prohibitively expensive.

Administrative Hassles:

Dealing with health insurance can be complicated and time-consuming. Individuals may need to navigate complex benefit structures, deal with claim denials, and spend time on the phone with customer service representatives.

Conclusion:

Health insurance is an important tool for managing the high cost of medical care. There are several different types of health insurance, each with its own benefits and drawbacks. Employer-sponsored health insurance is often the most affordable option, while individual health insurance can be a good option for individuals who are self-employed or who do not have access to employer-sponsored health insurance.

Medicare and Medicaid provide coverage for individuals who are 65 years of age or older, as well as individuals with low incomes. While health insurance can be expensive and may have limited coverage, it provides financial protection, access to medical care, and peace of mind for individuals and families.